Global Implications of the Coronavirus Pandemic

Kashvi Singh

The ongoing crisis due to the coronavirus outbreak has become the single biggest threat to the global economy. With more than 15,400 people already dead across the globe, it certainly poses a question about how concerned we should be regarding a possible global financial crash, if the virus keeps spreading at the current rate.

As of now,

the worst affected countries including China, Italy and Spain have imposed

heavy lockdowns in the regions, while other countries have only advised their

citizens to self-isolate. The British government has released a new wage

support scheme to ensure that financial loss suffered by businesses and by

those who are self-employed due to self-isolation is minimised. Many other

countries have also responded in a similar way by introducing financial help of

some sort to those affected due to self-isolation, which is a rather reassuring

sign as it encourages people to stay at home to control the spread of the

virus. Central banks across the world have also lowered their interest rates in

order to encourage borrowing, and thus, spending. However, one can question as

to what extent this could help in reviving the economy when people cannot step

out and spend in the first place.

As of now,

the worst affected countries including China, Italy and Spain have imposed

heavy lockdowns in the regions, while other countries have only advised their

citizens to self-isolate. The British government has released a new wage

support scheme to ensure that financial loss suffered by businesses and by

those who are self-employed due to self-isolation is minimised. Many other

countries have also responded in a similar way by introducing financial help of

some sort to those affected due to self-isolation, which is a rather reassuring

sign as it encourages people to stay at home to control the spread of the

virus. Central banks across the world have also lowered their interest rates in

order to encourage borrowing, and thus, spending. However, one can question as

to what extent this could help in reviving the economy when people cannot step

out and spend in the first place.

There are

however, questions about the degree of response by other countries that are at

the moment, relatively less affected. The tragedy in Italy only stands as a

warning to governments of other nations who are not taking the virus very

seriously, which again reflects the conflict between the health of the economy

and the health of the people themselves. While some nations are prioritising

their economy by not imposing lockdowns, some argue that this could lead to

even severe economic repercussions if a sudden spike in the number of cases

occurs, as was the case in Italy.

There are

also major concerns over the virus spreading into developing nations, as the

World Health Organisation (WHO) has warned - “A potential paralysation of

already vulnerable healthcare systems would not only have a drastic impact on

population health, but could also push people further into poverty and

deprivation”.

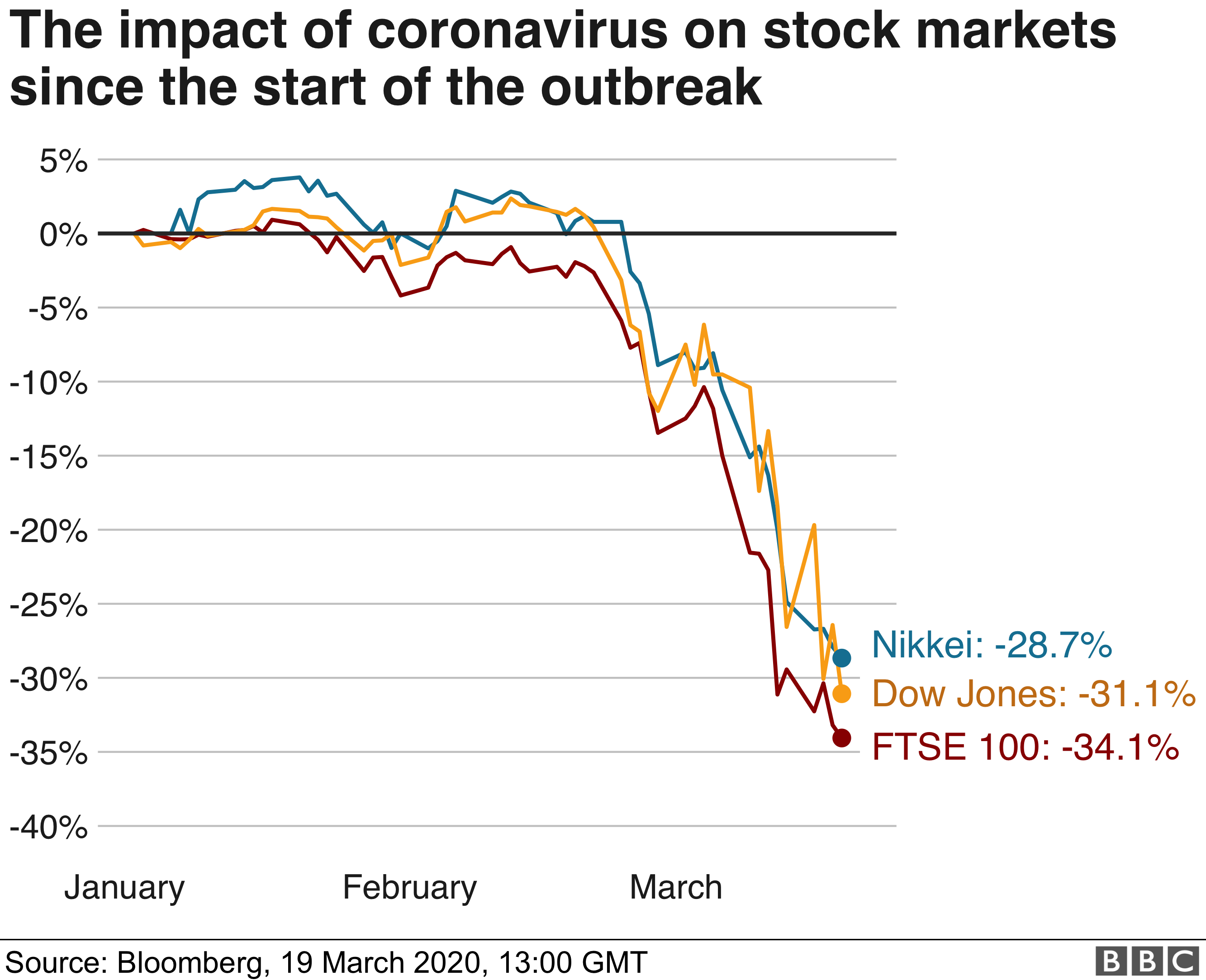

The fear

that has seeped in amongst investors regarding economic decline due to the

virus, is particularly dangerous, as it means that most of the burden of

economic renewal is forced onto the machinery of government. However, these are

only short-term impacts of the virus and there is sufficient evidence from the

past that suggests that ‘growth picks up pretty quickly post-pandemic’.

The decline

of the aviation industries, however, can make the economy more prone to slow

growth due to the high risks of unemployment caused by downsizing. On the 5th

of March, the International Air Transport Association (IATA) estimated that the

airline industry could lose between US$63 to 113 billion of revenues due to the

reduced number of passengers. Financial markets are now also anticipating a

large fall in airline profits globally, far beyond the SARS impact. This is

concerning as the aviation industry makes up around 3.5% of the world GDP,

which reveals why it is so crucial to revive this sector.

Comments

Post a Comment